Hanging Ten or Wipeout?

How was attendance at CDA?

What did Wall Street think?

We have the answers.

By Kevin Henry, Editor

Photo: The Anaheim Convention Center at twilight

Editor's Note: Following the California Dental Association Spring Session in Anaheim, I had the chance to sit down with Debi Irwin (pictured at right), the CDA's vice president of meetings and conventions, to talk about the show and her perspectives on attendance.

Kevin Henry: This was the second year that the Anaheim meeting used the Thursday to Saturday format rather than going from Friday to Sunday. How is the change of dates working out, in your opinion?

Debi Irwin: We asked our members what days they preferred for the meeting, and Thursday to Saturday was their answer. We tracked attendance at previous meetings and saw that Sunday wasn't well attended, so we made the switch to Thursday to Saturday. We ask at each meeting if we're meeting the needs of our members, and the new dates seem to be meeting those needs.

Henry: And what are you hearing from exhibitors about the Thursday to Saturday format?

Irwin: We're hearing that Thursday is busier than Sunday used to be. We want each day to be busy for the exhibitors.

Henry: Talk about your relationship with the CDA exhibitors.

Irwin: We view exhibitors as our partners. We know they enable us to bring a spring and fall meeting to our members. By partnering, we believe we can make the meetings better for our attendees and for the exhibitors.

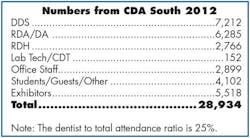

Henry: Talk about your attendance numbers from this year's spring session.

Irwin: We're really excited about them as they are the highest attendance numbers we've had. The dentist-to-attendee ratio went down a little, but it is still in the range that we wanted to see. I think the higher numbers also indicate that we're always improving the meeting and listening to what our members want and need.

Henry: How does it affect the Anaheim meeting during years when there is not a fall CDA meeting like this year when the ADA will be held in San Francisco?

Irwin: There is more focus on Anaheim in years like this. Our members know that anything that will be introduced will happen at this meeting. We certainly encouraged our members in northern California to make the trip to Anaheim, and I think that helped our numbers this year.

Henry: What are some of the things your members like most about coming to Anaheim?

Irwin: This meeting has a real campus feel to it with so many hotels and restaurants within walking distance. With the Hilton and Marriott so close, we have the flexibility to have more meetings and programs. Our meeting is also free to our members, so they know they can come here and get most of the CE requirements.

Henry: What changes did you make in this year's meeting, and what changes are in the works for future CDA meetings in Anaheim?

Irwin: We added a lot of digital signage this year, and we are looking at enhancing technology-based solutions in the very near future. We want to make it easier for our members to be at our meetings, so we are looking at technology solutions to help us with that. This year, we also tested a pilot program with overflow rooms for our more popular programs and we'll be expanding that next year. We used an overflow room for six lectures this year, and we'll use them for most courses in 2013.

CDA South notes from theWall Street analysts at RW Baird We attended the California Dental Association meeting, with key industry-wide conclusions including: • Improved domestic dental consumables trends largely persisting. While our checks suggest consumables demand softened in early April, late-April/early-May demand sounds as if it has rebounded back to 1Q levels. With Easter/many spring breaks falling in early April this year vs. late April last year, most sources seem comfortable early-April slowing was largely a timing issue. • Domestic dental equipment demand remains sluggish, likely growing low/mid-single-digits and in line with 1Q levels. As has been true for three+ years, demand for high tech equipment remains above basic equipment demand, although we're anecdotally hearing the gap between the two may be narrowing. Additionally, several sources are increasingly pointing to a potential late-2012 snap-back for basic equipment demand should dentists' sentiment improve throughout the year with improving patient demand. • Outside the U.S., we're hearing slightly less concern about Europe vs. earlier this year (a couple sources even pointed to improved European general dental demand thus far in 2Q), while Asia/Pac dental demand sounds as if it continues to grow mid/upper-single-digits. |