Section 179: What your customers need to know NOW

Editor’s Note: This identical article is appearing in the September issue of Dental Economics. I wanted to make sure you read exactly what your dentist customers are reading, hopefully giving you an edge when you walk into his or her office to talk about Section 179.

If you’re thinking about investing in your dental practice during the fourth quarter of 2008, things have never looked brighter. With the current income tax laws in effect, now is the time to schedule a meeting with your equipment sales rep and consider dental equipment purchases for your practice.

Unknown secret

Your CPA may have not mentioned this to you, but on February 13, President Bush signed into law the “The Economic Stimulus Act of 2008” (P.L. 110-185). This is huge change in current tax law. In fact, it is so large that the equipment write-offs under IRS Code Section 179 (“Section 179”) have increased from $125,000 to $250,000 (see below). There is also additional “bonus” depreciation available for newly acquired dental equipment. This article will address these two new concepts in tax law.

Understanding IRS Code Section 179

Most dental equipment will qualify for a five-year depreciation write-off, whereas furniture and fixtures (such as reception area furniture) will be written off over a seven-year period. However, the updated IRS Code Section 179 for 2008 allows you to elect to expense the first $250,000 of qualified dental equipment purchases in 2008. This will accelerate the depreciation deduction in year one, thereby doing away with traditional depreciation methods over a five- or even a seven-year period. IRS Code Section 179 property can be new or used and still qualify for the large expense deduction, as long as the equipment was not acquired from a related party.

The IRS Code Section 179 is so appealing that many of my colleagues within the Academy of Dental CPAs (www.adcpa.org) refer to this tax break as, “The Dentist Reinvestment Act of 2008.” I would like to encourage you to meet with your Dental CPA as soon as possible to discuss your particular financial situation and determine if the time is right for a major purchase of dental equipment.

This exciting change in the tax law for dentists – or the “$250,000 equipment expensing provision” ($125,000 in 2007) – is set to expire at the end of 2008, based on the “The Economic Stimulus Act of 2008” (P.L. 110-185). The new tax law extended the provision through 2008 only, after which the expensing amount will revert back to $125,000 in 2009, adjusted for inflation.

How does IRS Code Section 179 work?

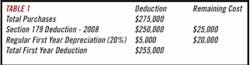

Let’s assume you’re thinking about purchasing Cone Beam Technology (an i-Cat at $175,000) and CAD/CAM dentistry (a CEREC at $100,000) for a total purchase price of $275,000. The IRS Code Section 179 deduction as mentioned above ($250,000) coupled with standard deprecation would mean the first year depreciation (2008) would be equal to $255,000 (see Table 1 below).

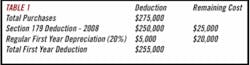

Assuming you are in the 40% tax bracket (combined Federal and State), your tax savings would be calculated as follows in year one, 2008 (Table 2):

As you can see from the chart, your tax savings in year one (2008) would be $102,000. Therefore, assuming you were to purchase the Cone Beam Technology and CAD/CAM dentistry both in 2008, your net cost would be $173,000 with after tax savings of $102,000 ($275,000 - $102,000 = $173,000).

IRS Code Section 179 … How can I make it work for me?

The dental equipment you’re thinking about purchasing during the fourth quarter of 2008 must be delivered and installed and in place by December 31, 2008. Please note: receiving an invoice from your equipment vendor dated December 31, 2008 or earlier does not satisfy the “placed in service” requirement from the Internal Revenue Service. The dental equipment must be on site, installed, and useable in order to meet the criteria of “placed in service,” as well as to qualify for the current-year accelerated depreciation tax deduction, IRS Code Section 179.

In addition to the above, there are special rules that deal with how much equipment you can purchase during 2008 and still receive the tax break of the $250,000 write off. The 2008 Section 179 Expensing Election has a cap based on the total dollar amount of Section 179 qualified assets purchased during a given year. The cap completely phases out the use of Section 179 for 2008 when the equipment purchases exceed $800,000 (in 2008). If you are building a new office and/or office facility, you should consider advanced planning with your dental CPA in order to optimize this tax deduction.

Do I have to pay for the equipment in full in order to receive the Section 179 deduction in 2008?

No, payment in full by December 31, 2008 is not required in order to receive the 2008 Section 179 depreciation deduction. However, you will need to obligate yourself financially for the equipment purchases. Prior to December 31, 2008, you could obtain a commercial loan from a financing institution, or you could use a credit card and charge such purchases (as long as they are charged by December 31, 2008). By the way, if you do charge, that is a lot of bonus miles!

Now that you understand IRS Code Section 179, it even gets better!

How does it get better, you may ask. “The Economic Stimulus Act of 2008” (P.L. 110-185), includes a provision for the “50% Bonus Depreciation Deduction.” This is set to expire as of December 31, 2008.

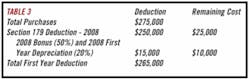

How does the IRS Code Section 179 for 2008 work with the “50% Bonus Depreciation Deduction?” Let’s use the same example as mentioned above – a total purchase price in the amount of $275,000. The IRS Code Section 179 deduction as mentioned above ($250,000), along with the 50% Bonus Depreciation and the standard deprecation, would mean the first year depreciation (2008) would equal $265,000 (see Table 3 above).

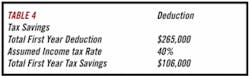

Assuming you are in the 40% tax bracket (combined Federal and State), your tax savings would be calculated as follows in year one, 2008 (Table 4, above):

As you can see from the chart, your tax savings in year one (2008) would equal $106,000; your net cost would be $169,000 with after tax savings of $106,000 ($275,000 - $106,000 = $169,000).

What other benefits could this significant tax deduction have?

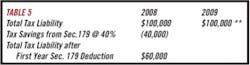

If your practice is an entity other than a C Corporation, the net income and all tax implications will be reported on your 2008 individual income tax return. In order to protect you from a tax penalty, you are required to have paid the lesser of 90% of your total 2008 federal tax liability or 110% of your 2007 total federal tax liability. This is achieved through timely 2008 quarterly estimated tax payments or payroll withholdings on your 2008 W-2. If you do not meet either of these requirements, you will be subject to an underpayment of estimated tax penalty. Most states have similar requirements. In order to illustrate the tax impact for both 2008 and 2009, please see the chart below (Table 5).

Let’s assume your total tax liability for 2008 and 2009, prior to the 2008 accelerated deprecation, is $100,000 and you do indeed purchase just $100,000 of equipment in the fourth quarter of 2008 and take advantage of the 2008 accelerated deprecation.

** In order to meet the Internal Revenue Service guidelines for establishing whether or not you are in a tax penalty position for 2009, you will need to pay taxes as follows in 2009: you are required to have the lesser of 90% of your total 2009 tax liability ($90,000 = 90% x $100,000) or 110% of your 2008 total tax liability ($66,000 = 110% x $60,000). So as you can readily see, taking advantage of IRS Code Section 179 delays the timing of income tax payments in not only the current year but also into the immediate future year. The balance of the 2009 income tax liability, or ($34,000 = $100,000 - $66,000) would be due to the Internal Revenue Service by April 15, 2010!

Not sure you could get there?

If you are unsure whether you could possibly spend $100,000 plus for dental equipment, it seems easy even with one piece of dental technology. Take for example the latest in Cone Beam Technology, the i-Cat. This equipment ranges from $100,000 (Gendex CB-500) to $175,000 (Imaging Sciences). So as you can see, it is easily obtainable. In fact, Dr. Charles Blair, one of the nation’s leading dental consultants, recently addressed the Academy of Dental CPAs (www.adcpa.org) informing them that the i-Cat will become the standard of care in the very near future.

Some common questions

Would you believe your itemized deductions along with your personal exemptions are also impacted by IRS Code Section 179?

Itemized deductions and personal exemptions are subject to phase-out as your income increases. As your income decreases (from the benefit of the IRS Code Section 179) the phase-out itemized deductions and personal exemptions also decrease, and as a result, so does your tax liability!

How do I know how much equipment to purchase?

You now ask yourself, how do I know how much equipment to purchase and what will be its impact on my income taxes? Consider meeting with your dental CPA and run the numbers. There are too many factors to be considered and each and every situation is different.

What happens to the old equipment?

Let’s assume your new dental equipment is in place. To the extent that it is replacement equipment, you now have to deal with the old equipment. There are basically three alternatives – keep it as a backup, sell it, or donate it. To a large extent, the condition of the equipment may dictate the decision.

Let’s look at the consequences of each of the three options.

You keep it as a backup. The equipment has been taken out of service as of the date the replacement unit is put in service. Depreciation stops as of the date it is taken out of service. It restarts if and when the equipment is placed back in service. You now are faced with storage of the unit. If it is stored onsite and is in a room that could otherwise be used to generate income, you may want to evaluate this. And if storage is offsite, consider rental charges and if the equipment will be easily accessible if needed to be placed back in service in the event of an emergency.

You sell it. Depending on the selling price and the book value of the unit, there will either be a gain or loss. If there is a loss on sale, it is an ordinary loss – deductible dollar for dollar against income. If there is a gain upon the sale of the equipment, it will be a capital gain to the extent that the gain exceeds depreciation deducted on the unit and taxed as such depending on the practice’s form of organization. The depreciation taken is recaptured as ordinary income and taxed as ordinary income.

You donate it. If the equipment has been depreciated, your deduction is limited to the difference between the original cost and the accumulated depreciation – not the fair market value.

Working with a dental CPA

During the fourth quarter of 2008, many dentists will meet with their dental CPAs as a result of these significant tax changes. You may also want to meet with your dental equipment vendor in order to obtain the necessary information on the equipment specs. As we approach this fall, it is important for you to plan early and get commitments from your equipment vendor so that he or she can guarantee you that pre-January 1, 2009 delivery and installation dates are obtainable. There is no better time than now to begin retooling your dental practice. If you are thinking of transitioning or selling your dental practice in the near future, why not invest in technology today to preserve its value?

A dental CPA can minimize your tax liability and at the same time, assist you in the accumulation of your wealth. To locate a qualified member of the Academy of Dental CPAs near you, please visit www.adcpa.org. Dental CPAs specialize in rendering professional services to your industry. They have in-depth knowledge of how your industry works and they constantly study ways to ensure that you take full advantage of tax breaks that are available for the dental industry. The dentist of today should become familiar with these tax law changes and take advantage of the current law while it is in effect.

Allen M. Schiff, CPA, CFE, is the Managing Member of Schiff & Associates, LLC. In addition, Schiff co-founded the Academy of Dental CPA’s in October 2001. Schiff has more than 30 years of expertise in the areas of dental practice management. His service offerings include business planning to include obtaining financing, transition planning, exit strategies, and long-range planning. Schiff has assisted dentists over the years with practice acquisitions, start-ups as well as fraud prevention and associate contract analysis. He can be reached by email at [email protected].