How do the new tax laws affect you?

The legislation provides $1.35 trillion in tax relief in several areas over the next 10 years, so it is not so much a question of whether, but how it will impact your situation.

In June 2001, Congress enacted sweeping new tax legislation. Officially, it is called the Economic Growth and Tax Relief Reconciliation Act of 2001.

While the media have focused on the reduction in individual income taxes, other aspects to the legislation can benefit individuals or families in a variety of ways. One example is a significant increase in the amounts you can contribute to popular investment accounts such as Individual Retirement Accounts (IRAs) and 401(k) plans.

I would like to present an overview of basic aspects of the legislation. The legislation provides $1.35 trillion in tax relief in several areas over the next 10 years, so it is not so much a question of whether, but how it will impact your situation.

The centerpiece of the bill is an across-the-board reduction in individual income tax rates. The bill also includes key retirement-savings provisions, doubles the child tax credit, provides tax relief for married couples, expands education-savings tax incentives, and proposes to repeal the estate tax. Let's look at these changes individually.

Lower tax rates — Most taxpayers will see some savings. A new 10 percent tax rate has been created, retroactive to January 1, 2001, which applies to every taxpayer. Additionally, the existing tax-rate brackets will be reduced gradually over the next six years.

Because the rate changes are retroactive to last year, many taxpayers will receive an immediate refund. Depending on your income and filing status, single taxpayers will receive up to a $300 lump-sum refund; single parents may receive up to $500; and married couples may receive up to $600 for the tax year 2000.

Retirement savings — The new tax law makes extensive changes to the rules relating to IRAs and qualified pension plans. Primarily, the changes are designed to allow individuals to save more for retirement through tax-advantaged plans and to increase pension plan coverage.

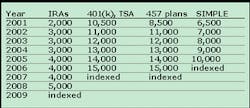

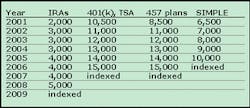

The chart on page 49 illustrates new contribution maximums and the phase-in periods for popular retirement-savings vehicles.

For those retirement-plan holders age 50 and older, there are new contribution catch-up provisions for IRAs, Roth IRAs, and 401(k)s. IRAs and Roth IRAs will allow an additional $500 contribution each year for 2002 through 2005 and an extra $1,000 starting in 2006. 401(k) plans will accept an additional $1,000 in 2002, phasing in to $5,000 by 2006.

Rollovers and portability — You now have flexibility to roll retirement-plan assets from the various types of tax-advantaged plans to each other without restriction. Starting with distributions made after 2001, the new law expands rollover options, offering further incentives for individuals to keep distributed retirement benefits in tax-favored accounts. 401(k) to 403(b), 457 to IRA, IRA to 401(k) — you now have a choice.

As you change employment and consider rolling your accumulated retirement assets out of your prior employer's plan, it is important that you review the parameters and provisions of each type of plan before making a move.

Estate-tax planning — The new tax law calls for a repeal of the existing estate tax, although it wouldn't occur until 2010. Under the 2001 tax law, the estate-tax value upon which non-estate tax would be due, or the unified credit exemption amount, is $675,000. Under the new tax laws, which take effect in 2002, this dollar amount is increased to $1 million, with additional incremental increases through 2009.

After repeal in 2010, the act replaces step-up in basis with carryover basis for transfers to heirs at death for assets in excess of $1.3 million and spousal transfers in excess of $4.3 million.

Additional reporting requirements for large gifts and bequests will be required. As the law stands currently, in 2011 estate taxes will resume at a 55 percent tax rate, with a $1 million exemption.

Education savings incentives — A number of provisions have been adopted to expand education savings accounts, qualified tuition plans, the student-loan interest deductions, the exclusion for employer-provided education assistance, and tax-exempt financing for school construction. Primary Education IRA incentives include these:

- Contribution limits will increase from $500 to $2,000 in 2002.

- Withdrawals can now be used for private elementary schools, as well as college.

Additionally, withdrawals from 529 college-savings plans are exempt from federal income taxes (when used for tuition, books, or room-and-board expenses).

Child tax credit — The new tax law doubles the child tax credit over the course of the next nine years, beginning in 2001. It increases to $600 per child for 2001-2004; to $700 per child for 2005-2008; to $800 in 2009; and to $1,000 in 2010.

Marriage penalty relief — The tax burden should be reduced for many married couples. For couples filing joint tax returns, the tax-rate bracket will be increased gradually to twice the size of the bracket for singles, beginning in 2005. Additionally, the basic standard deduction for married couples filing jointly increases to twice that for singles, phased in over five years, beginning in 2005.

Many other detailed changes could affect your specific tax situation, including changes to the alternative minimum tax (AMT), dependent-care tax credits, adoption tax credits, and earned income tax credit.

The variety and breadth of these changes can be overwhelming. Your financial adviser is in a position to provide you with information so that you may take advantage of them. Many aspects of your life also can change during the years that phases of the new law are implemented, so make sure you revisit your financial plan annually to make adjustments.

This is for general information only. We suggest that you consult your attorney, accountant, or tax adviser for specific advice with regard to your individual situation.

Kathleen Adams, RDH, BS, is a financial adviser with Waddell and Reed (www.waddell.com). She is currently trying to initiate money-management workshops for hygiene students and specializes in working with dental professionals. She can be reached at (800) 210-1357.