Dentistrys Profits

A sampling of dental offices shows where the money is.

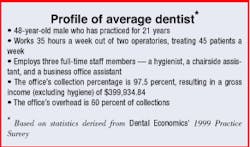

A reasonable assumption to make is that dentists earn a respectable income. They may not be the envy of venture capitalists, but, as long as teeth hurt and glamorous smiles are desired, the cash keeps pouring into the till. Every year, Dental Economics magazine surveys a sampling of its readers for statistics about the financial operations of a practice. RDH, a sister publication of Dental Economics, shares information below from the 1999 survey that may be of interest to hygienists.

A total of 360 doctors from across the country completed the survey`s questionnaire at Dental Economics` request. All of the dentists surveyed were general practitioners, and 79 percent operate solo practices.

Collecting fees

More than 75 percent of the practices reported collection rates above 94 percent. Most of this group said the rate was between 97 and 98 percent.

For the most part, though, less than half of collections is being paid up front as patients depart. Only 37 percent of the practices said more than half of their collections are obtained at the "front desk." Most practices (54 percent) are being paid less than 40 percent up front. And, yes, 86 percent of the practices accepts credit cards.

Credit cards, according to 66 percent of the practices surveyed, are used by fewer than 15 percent of the patients. On the other hand, there may not be a sweeter sight than the mailman. Seventy percent of the practices revealed that they obtain at least 50 percent of their collections through the mail.

Although credit cards are acceptable, Dental Economics asked readers if a "health-care-type payment option" is offered. These payment plans are available at only 36 percent of the dental offices.

Part of what arrives by mail is reimbursement from third parties. Although payment for fee-for-service treatment accounts for 33 percent of all fees, dentists said the remaining fees are being reimbursed from indemnity insurance or managed care programs. The impact of managed care programs appears to be minimal, since 64 percent of the practices said less than 10 percent of their fees are reimbursed by managed care programs. The effect of indemnity insurance programs remains strong, however, since 52 percent of the doctors said a range of 30 to 60 percent of their fees are being paid by indemnity plans.

Sixty percent said they have not discounted fees for patients under a managed care plan.

Translating collections into income

Dental Economics asked readers for their "personal gross-dollar collection income" for 1999. The magazine believes that reporting the total amount of fees collected is a better indication of gross income. The median income reported was $399,934.84. This median income includes hygiene production; when hygiene is excluded, the median gross collection income is $310,100. The highest gross collection income reported was $1.4 million.

Dental Economics calculated an 8.4 percent increase in personal gross income (before taxes) from statistics generated from its 1998 survey. The two annual surveys, however, did not necessarily poll the same dentists. The magazine estimated that only 27 percent of its readers reported an increase in gross income in excess of 11 percent.

In terms of specific income brackets, though, about half of the readers fell into two separate groups. When hygiene production is excluded from the calculation, approximately 22 percent indicated gross income between $150,000 to $250,000, while another 22 percent said their personal gross was between $450,000 to $700,000. However, hygiene production boosted the number of dentists in the $450,000 to $700,000 bracket to 33 percent.

In examining the group reporting the $450,000 to $700,000 personal gross income, it was interesting to note that professional maturity (the number of years in practice) did not dramatically dominate the statistics. A breakdown of various experience levels in the income bracket of $450,000 to $700,000 revealed the following percentages:

- Under five years experience, 11 percent of doctors fall into this income bracket

- Six to 10 years in practice, 30 percent

- 11 to 15 years in practice, 34 percent

- 16 to 20 years in practice, 22 percent

- 21 to 25 years in practice, 43 percent

- 26 years or more, 23 percent

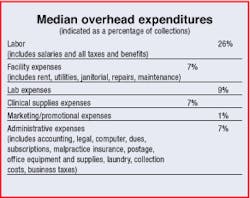

Paying the bills

As always, the biggest bite out of the personal gross income goes to overhead expenses. Overall, about 60 percent of collections is consumed by overhead. But 30 percent of the Dental Economics readers indicated that overhead was less than 50 percent of collections in their practices.

A better explanation of overhead expenses can be seen in the related chart. As indicated in surveys from previous years, labor continues to represent the biggest chunk of expenses. Although the median number of full-time personnel in offices was three, 40 percent of the respondents indicated they employ four or more full-time staff members. In addition, only 30 percent said they do not employ part-time staff.

More details about staffing trends include the following:

- 43 percent do not employ a full-time hygienist

- 43 percent employ one full-time hygienist

- 49 percent do not employ a part-time hygienist

- 34 percent employ one part-time hygienist

- 45 percent employ one full-time chairside assistant

- 28 percent employ two full-time chairside assistants

- 65 percent do not employ a part-time chairside assistant

- 21 percent employ one part-time chairside assistant

- 55 percent employ one full-time business office assistant

- 22 percent employ two full-time business office assistants

- 62 percent do not employ a part-time business assistant

- 28 percent employ one business office assistant

- 67 percent do not employ an assistant who handle both chairside and business office duties

Other expenses are dues and continuing education courses. Fifty-eight percent of the doctors estimate spending $1,000 to $4,000 annually on related expenses.

In terms of workload, half of the doctors (55 percent) said they work four days a week - usually for a total of 32 to 37 hours. Fifty-four percent said they personally work out of two operatories, although 21 percent indicated using three operatories.

Most of the doctors (82 percent) are setting aside funds in a retirement plan. The majority (58 percent) contribute less than $15,000 a year to a plan.