Minimizing debt on a RDHs salary

An effort to be more frugal ensures more security later.

Jan Mengle, RDH, MHS

You graduate from hygiene school and spend five years working in private practice earning $38,000 a year. In those five years, you purchase a car, travel overseas twice, and own a designer wardrobe. These expenses suit your lifestyle and, by age 35, you are very committed to this type of spending.

Your friend, who graduated the same year and now is earning $37,000 a year, began financial planning very soon after employment. She met with a financial planner and was advised to contribute the maximum amount allowable to a 403(b) retirement plan. In addition, she was advised to establish an emergency fund and set up an IRA account to which she would contribute on an annual basis.

If you identify with the free-spending hygienist, you may be headed for financial trouble. The frugal hygienist can look forward to financial security in retirement.

As health-care professionals, we seldom are introduced to financial planning during our course of study. If financial management was introduced in the curriculum, it was limited to one or two lectures on practice management, which dealt more with the mechanics of office management. So, if we don`t have a parent or spouse who is a guru in money management, we may look at saving and investing as something "we hope to do one day."

Many private practices do not offer insurance or retirement incentives. The responsibility of allocating funds for saving and investing falls on the individual.

It behooves the hygienist to organize data regarding saving, insurance and investment needs and present them to the office manager or employer as early as possible. More practices are offering retirement options for employees. As more employees petition for retirement options as part of their benefits, a greater number of employers will introduce these options.

Before it`s too late, the frivolous dental hygienist would do well to curtail spending and begin to consider more realistic needs for her future - emergency savings, insurance, and retirement investments.

Control debt. Unlike the free-spending hygienist, you feel it`s important to ensure your future financial security. But where do you begin? Start by ridding yourself of as much debt as you can as soon as possible. For many wage earners, that means the close monitoring of credit-card use, especially when cards are used for long-term credit. If you must use credit cards, use them sparingly and for short-term credit.

You can use your credit card for the convenience it offers. Many credit card banks offer special incentives for people using cards more frequently for short-term credit. Paying off your card balances monthly eliminates high interest rates. Prudent money managers take advantage of short-term card use, which allows them the freedom to spend debt-free.

Long-term credit, on the other hand, may offer some dividends down the road. A tax break that no other investment can match is the home purchase. Up to $1 million of mortgage debt for a home you buy or build is completely deductible. This could be beneficial come tax time.

Emergency fund. A firm savings plan begins with an emergency fund. It`s recommended that this fund be large enough to cover three to six months of living expenses. By placing this money in a money market fund, you will earn interest as you are building a fund that you can access quickly in case of emergency.

Insurance. As health-care professionals, liability insurance is imperative. Many employees automatically are covered under their dentists` liability policy. Prior to employment, however, you should determine what your liability coverage is and the amount for which you are protected. If you are a member of the American Dental Hygienists` Association, you can join a plan for a minimal annual fee. It is recommended that you purchase insurance for at least twice the value of your net worth (assets minus liabilities).

Disability insurance is a valuable asset to replace lost income in the event that you cannot work. Long-term disability was, at one time, the method of choice when purchasing disability coverage. As few people remain disabled for more than six months at a time, short-term disability insurance has become a popular choice.

If you are the provider in your family, life insurance provides your family with security in the event of your death. Shop around when considering insurance companies and scrutinize your premium costs. Many people pay exaggerated premiums and, come collection time, receive far less than was anticipated. Term-life policies frequently are recommended, as you receive pure insurance protection for your money.

We may get by without life or disability insurance, but the average wage earner who neglects to purchase health insurance is taking a big risk. Some employers may have comprehensive health plans for their employees for a minimal salary deduction. If the employer does not have a health plan, you may have to investigate health-care insurance on your own. When selecting health insurance, take the highest deductible you can afford, as it helps in reducing the cost of the plan. Make certain, however, that you understand just what your policy will, and will not, cover prior to accepting a plan.

Most dental practices offer dental services to employees. Where some offices present a flat 20 to 50-percent reduction on all dental services, others may charge a lab fee or, better still, offer dental care free to employees and their families. These services are arranged upfront and are entirely set by the individual dental practice. Corporate clinics may have set policies for dental services in employee benefit packages.

Saving and investing. Your financial strategy must look at saving over a short and long period of time. What is your current age? When are you going to need the money you are saving? About how much money would allow you to live comfortably in retirement? If you are 24 and are allocating 10 percent or more of your pretax income, you just may be able to retire comfortably by 45 or 50. If you are 45 and just beginning to set aside 10 percent for retirement, your expectations for early retirement are diminished considerably. One absolute key to making money is growth of your money over time.

The ideal way to begin money allocation is to determine how you currently are spending your money. Collect data as to how you typically spend your money over a three-month span. Assess your checkbook, document daily expenditures, and identify essential and nonessential spending. Calendar books are great for this type of documenting. Now, determine the areas in which you overspend on non-essentials and determine what cutbacks you can make.

As hard as it is to admit, all of us have some fat in our budgets. Thomas O`Hara, National Association of Investors, promotes the following successful investing principles:

- Invest a set sum of money regularly, preferably once a month throughout your lifetime.

- Reinvest earnings each month, along with making new financial contributions. Use dollar-cost averaging.

- Choose investment companies that have the likelihood of being worth substantially more five years in the future.

According to O`Hara, it`s not the third step, but the first and second steps that trip people. Pre-payroll deduction is an excellent method of saving because it allows the investor to make pain-free contributions. Money contributed to an employer-based retirement plan [401(k), 403(b)] or a self-employed plan (such as SEP-IRA and Keogh) generally is tax-deductible. These contributions are free of both state and federal taxes for the year in which you made the contribution. The money compounds over time and will be nontaxable. This manner of saving is one of the best ways to make your money grow while reducing your taxes short- and long-term.

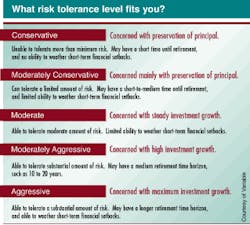

Where should you put your money for the greatest growth? It depends on the amount of risk you`re willing to take. The better the return on your money, the greater the risk. Could you afford, say, a 200-point drop in the stock market? If you are very near to retirement, perhaps not. But if you have many years until retirement, your portfolio may withstand such a loss. Money markets (frequently FDIC-insured) and Treasury bonds are safe places to keep money if you expect to use it in the near future. Bonds also may be useful for some long-term diversification.

As a rule, bond and money market investing help to buffer stock market declines. However, when investing in bonds and money markets, expect less return.

Stocks or stock funds historically offer better returns. Even when the Dow Jones Average fell more than 20 percent in a 100-year time span (16 times), the declines lasted, on average, less than two years. With a proper diversification of funds and long-term investing, risk may be tolerable.

One rule when allocating between growth stock investments and bond investments is to subtract your age from 100 and invest the resulting percent in stocks and the remainder in bonds. If you are 30 years old, you could invest from 70-90 percent in stocks and 10-30 percent in bonds.

You can choose to invest in stocks by making selections of individual stocks or by having a fund manager purchase them for you. Some in-vestors prefer independent services, such as Morningstar or Value Line, to guide their choices. Most stocks or stock mutual funds are measured against the S&P 500 stock index.

If the money you are investing is going into a 401(k), 403(b) or your employer`s investment plan, you more than likely have five or six investment choices. A typical portfolio may offer a fixed-income fund, an S&P 500 index fund, growth fund, international fund and a bond fund among the investment choices. Those investors on the skittish side may choose to put 70 percent of their money in fixed income and 30 percent in index and growth.

This allocation, however, offers far less growth return over time. Managed properly, your retirement allocation can make you a millionaire, especially if you start early. Your allocations are tax-deferred and some employers match your allocations. A 25-year-old earning $30,000 a year and stashing 10 percent into a retirement 401(k) with annual returns of 6 percent could end up with $1.3 million by age 65.

Each dollar you tuck into your account is deducted from your taxable income. So you avoid taxes (not in Pennsylvania) on the money until you withdraw it. All the interest, dividends and capital gains that you earn in your account continue to grow tax-free until withdrawal. This type of investing is superior to investing money outside the tax-sheltered retirement accounts and, with your regular contributions, you are addressing at least one of O`Hara`s rules for successful investing.

As you invest and continue to receive salary increases, adding IRAs and stock funds to your portfolio will improve your earnings even more. Financial advisers advocate diversification within a portfolio and urge you to have your retirement goals reviewed annually. It is satisfying at the end of each quarter to assess your investment returns.

At first, organizing and allocating your money to meet the needs and demands of your life can be burdensome. But once your emergency, insurance and retirement plans are set, you will have more freedom with money allocation and feel more secure about the present and the future.

References

- Tyson-Eric, Moneywise: Managing your Financial Climb; Special advertising section; Newsweek, Vol: v 127, Iss. N 14, p S1 (u), Apr. 1, 1996.

- P. W., Special 401(k) Report, Money, p. 96-99, June, 1996.

- Coupe, A. H.; Follow Fundamentals for Successful Investing; Trends; Business Monday; The News Journal, D7, Mon.; July 31, 1996.

- O`Hara, Thomas E.; Investing in Individual Stocks; Moneywise; Special advertising section; Newsweek; Vol: v 127; Iss. N 14, p S1 (u), Apr. 1, 1996.

Jan Mengle is an assistant professor of dental hygiene at Armstrong Atlantic State University, University System of Georgia. The author extends her appreciation to Victoria A. Tavoni, MBNA Bank America, Wilmington, DE, for assistance with this article`s content.