A Dental Analyst’s Recap – ADA Annual Session

by Jeff Johnson, OD, CFA

Dental tradeshows are a great way for dental practitioners and staff to catch up on continuing education, see new products, and learn new practice management ideas. While dental investors don’t need (or want!) the CE hours, they like to see the latest and greatest technology. For that reason, we took a group of investors to this year’s ADA and walked them through a number of the manufacturer and distributor booths. Here we provide our thoughts regarding key takeaways from this year’s ADA.

Along with the IDS dental tradeshow in Germany and the Chicago Midwinter meeting, the ADA annual meeting is one of the most comprehensive tradeshows in the industry, with more than 700 dental companies exhibiting and an estimated 45,000 dental personnel attending. As was the case at the February Midwinter meeting, IDS in March, and most major meetings the last several years, a highlight of the ADA meeting was practitioner interest in digital imaging and other advanced technologies.

From a macro perspective, we left the ADA convinced that the industry is a recession-resistant place for investors to hide during times of economic uncertainty. While U.S. economic uncertainty has risen in recent months due to a weak housing environment and the sub-prime mortgage debacle, our discussions with several leading dental manufacturers and distributors suggested that the economy has not reached the point where significant risk is meaningful. On the dental consumables side of the industry, many manufacturers and distributors continue to report healthy demand for their products and — barring a sudden rise in the unemployment rate and thus a potential fall-off in dental insurance benefits — expect steady growth during the coming years.

On the dental equipment side, most providers offered an upbeat assessment of current trends, noting that demand for dental operatery remodeling and moves into more sophisticated technology should be enough to support mid single digit sales growth in basic operatory equipment, and mid-teens to 20 percent-plus growth in digital imaging and other high-end equipment. Additionally, our checks suggest the federal government’s recent decision to lower interest rates has, not surprisingly, reduced dental equipment financing rates.

The “recession resistant” nature of the dental industry is one of the key reasons dental stocks performed well through the summer and early fall of 2007, even as the rest of the stock market faltered. Of course, strong numbers coming out of several dental manufacturers and distributors helped. For the first nine months of 2007, the Robert W. Baird Dental Market Index, a market-cap weighted index including PDCO, HSIC, XRAY, SIRO, ALGN, YDNT, and BLTI, is up 25 percent year-to-date through October 5 vs. the S&P 500’s 10 percent gain.

Below are some of the company-specific highlights coming out of this year’s ADA. As you read these comments, keep in mind that we are not dentists and do not work for these companies, so our thoughts are purely our opinion of trends within the industry and these companies.

DENTSPLY (XRAY): Because DENTSPLY offers such a broad array of products, many of the over 25 new products the company introduces each year are evolutionary in nature and often cannibalize prior-generation products. At this year’s ADA, however, we saw two products at the DENTSPLY booth that we believe are incremental to the company’s current business — the Raintree Essix “minor-tooth-movement” system, and the D-Carie mini (NEKS Caries Detection Device). In our opinion, these products illustrate the company’s ability to quickly commercialize acquired technology. The D-Carie mini caries detection device was acquired this past summer, and Raintree Essix, acquired in 2005, was highlighted by the company at the same time the plastic aligner business was gaining credibility in the industry.

Our checks suggest XRAY’s “minor-tooth-movement” system retails for about $999 and provides dentists with the tools to fabricate plastic aligners within the office and make minor adjustments (0-3 mm) to a single tooth or a couple of teeth. Key selling points with this system are ease of training (one day) and the financial opportunity (management noted some dentists charge as much as $1,500 for this treatment, meaning breakeven is less than one case). While never a sure thing, our research suggests there is little risk of IP-related issues with Align Technology, as XRAY uses no digital planning or other advanced methodologies that might infringe the technology associated with the Invisalign process.

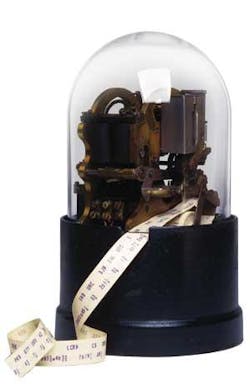

As for the D-Carie mini, we were surprised that XRAY is already launching and prominently featuring this product following the recent Q2-07 close of the acquisition of NEKS. The D-Carie mini is an aid in identifying the presence of occlusal and interproximal caries in wet field environments. The detection technology emits an LED light and captures the resulting reflection and refraction in the tooth. A specific optic signature identifies the presence of caries. The detection handpiece is cordless and lightweight. The market for caries detecting devices like this has developed quickly, with Danaher/KaVo’s DIAGNOdent system — the only such system currently on the market — being used in roughly 20 to 25 percent of dental offices. XRAY’s list price for D-Carie mini is about $3,099, compared to $3,150 for DIAGNOdent. We estimate this product could grow to become a $5 million to $10 million annual contributor to the company over the next one to two years, assuming penetration of caries detection devices continues and XRAY is capable of gaining some share. While the D-Carie mini lacks DIAGNOdent’s capability to numerically track the level of tooth decay in a specific tooth, the audio-visual feedback of the system (green light indicates a healthy tooth structure, red light indicates decalcification of the examined tooth and the audio beeps ranging in speed (slow to rapid) indicates the presence and location of caries) and the ease of the device could be competitive advantages.

Sirona (SIRO): Sirona featured several new products during the ADA annual session. These included CEREC and its recent updates (MC XL and Biogeneric software), the Galileos 3-D CBCT system, and the Sirona XIOS digital intraoral sensor with CMOS technology.

Galileos 3-D CBCT System: Feedback at the ADA confirms that practitioner interest in 3-D CBCT systems is high, although sources suggest that purchases of CBCT systems, including systems from all manufacturers, is below what was expected. We believe roughly 225 to 250 CBCT systems have been sold in the U.S. this year, with about 400 systems a good estimate for the full year. While the $160,000-plus cost of these systems is one of the reasons they are not “flying off the shelves,” the large number of new players entering this market has created some confusion, or at least caused dentists to evaluate their options, leading to a longer-than-expected selling cycle.

CEREC: MC XL milling unit upgrade demand from current owners remains robust for SIRO, but new end-user demand remains limited given that the new system has only been widely available for several months. We hope to gain more insight into new user demand trends over coming quarters, and from a long-term perspective, we believe additional in-office CEREC applications could stimulate end-user demand. Specifically, SIRO could be working a plan where several teeth could be imaged in-office using the CEREC handpiece, and these images could then be transmitted directly to the lab. While SIRO already competes with its CEREC inLab system, it requires a standard paste-based impression be sent from the dental office to the lab, and this potentially new application for CEREC could eliminate the paste-based impression step. As other digital impression systems come to market (Cadent’s iTero system, 3M/ESPE’s C-O-S intraoral scanning system), we believe SIRO could compete in this market. We would not be surprised if CEREC in-office capabilities were to expand, with the potential for three unit bridges and more when in-office ceramic materials improve.

Digital Intraoral Imaging: Following the acquisition of Schick last year, SIRO is the leading provider of digital intraoral radiography sensors in the U.S. market. Our conversations with several companies suggest digital radiography sales have spiked and are expected to grow at a mid-teens to 20 percent-plus clip.

Danaher (KaVo, Dexis, Gendex, ISI, Pelton & Crane, Sybron): Danaher entered the dental market in 2004 via the $500 million acquisitions of German-based KaVo and DENTSPLY’s Gendex imaging business. Since then, Danaher has completed five more acquisitions totaling $2.5 billion, and the company has quickly become one of the leading manufacturers in the $16 billion dental industry.

Conversations with Danaher personnel suggest that dental equipment demand remains healthy, with basic dental operatory equipment sales growing in the mid-single-digit range and the intraoral digital imaging market growing at a 20 percent-plus clip. Danaher management said they believe strong demand for digital radiography will continue, as only one-third of practices currently own such technology.

Danaher is the leading 3-D CBCT imaging company because of its acquisition of I-CAT manufacturer Imaging Sciences International in 2007. DHR is pleasantly surprised by the high level of interest in 3-D CBCT systems. Unlike some of the others, however, Danaher became recently successful at translating this interest into sales. Our sources suggest I-CAT sales have accelerated the past couple of months following the launch of an upgraded version of the I-CAT system in July. The cross training of HSIC’s sales force on the I-CAT system may have diverted some selling focus from these systems, but as this cross-training is complete and HSIC reps effectively detail this and other CBCT products, sales have improved.

3M/ESPE: Although 3M/ESPE’s booth featured many innovative products, including its Protemp Crown Temporization Material, we spent most of our time learning about the company’s new chairside scanner introduced following the 2006 acquisition of Brontes Technologies. As a reminder, 3M paid $97.5 million to gain access to Brontes’ Digital Impression technology, a chairside video-based intraoral scanner that is generating buzz in the industry.

The goal of the chairside-optical-scanner (C-O-S) system is to enable dental offices to digitally capture an impression of teeth, potentially eliminating the need for paste-based impressions. Once the digital impression is captured chairside, the scan is submitted to 3M for the manufacture of a standard dental model. That model is then sent to the lab.

More than 50 million in-office impressions are created annually in the U.S., and they are one of the most problematic, because patients simply don’t like having a tray full of goopy paste in their mouths. A recent survey of dental labs by trade magazine Lab Management Today showed that there are other problems with paste-based impressions, and one of the biggest problems labs face is the inadequate level of detail these paste-based impressions provide.

Because this technology could have a significant impact on the $500 million to $600 million U.S. paste-based impression market, we plan to watch the success of this product over the next 12 to 18 months. If 3M/ESPE gains traction with its video-based C-O-S, we believe it could put pressure on manufacturers such as DENTSPLY and Danaher/Kerr, which hold the No. 2 and No. 3 positions in the impression material market. (3M is the leading manufacturer of paste-based impression material.) 3M plans to slowly roll out this product as it works to advance the technology needed to convert digital dental scans to physical models. We expect the company to make about 50 units available in 2007 and another 500 units in 2008, before they launch it market-wide in 2009. Finally, pricing for the digital scanner portion of this system could be in the $18,000 to $30,000 range, with the potential for a per-use/click fee of about $25. (Competitor Cadent charges an upfront fee for the iTero system and a $25 click fee per use).

Henry Schein (HSIC): Rumors were circulating at the ADA show that the E4D chair-side CAD/CAM system manufactured by D4D Technologies will be exclusively distributed by HSIC in the U.S. and launched in mid-November. A large number of systems could be sold by year-end, and we believe that a “soft” launch of the E4D system is likely in 2007. The limited promotion of a launch at this key tradeshow and feedback that more work is being done on the E4D leads us to believe a broader launch is likely in 2008, potentially at the February Chicago Midwinter Meeting.

As noted above, HSIC is the exclusive U.S. distributor of the I-CAT 3-D CBCT system, and sales have accelerated, so HSIC is likely to again deliver healthy dental equipment growth in its Q3 results. For three consecutive quarters, HSIC has delivered North American dental equipment growth in excess of 20 percent, performance that has been helped by both the Biolase and ISI exclusive distribution agreements signed in 2006.

Patterson Companies (PDCO): PDCO had two equipment purchasing incentives running at the ADA, including an interest rate financing deal (4.9 percent for 12 months, 5.9 percent for 24 months, and 6.9 percent for 36 months) and a CEREC customer satisfaction guarantee. The financing special has been in place since Sept. 1 and management hopes that this special combined with tax incentives on capital equipment will convince dentists to make last-minute purchases in 2007. As for the CEREC guarantee, PDCO will fully refund a CEREC purchase any time over the next year if a new chairside CAD/CAM system (E4D) is launched and the dentist prefers that system. This incentive is designed to move dentists off the sidelines if they want to move into CAD/CAM technology but are waiting to evaluate the E4D.

While near-term benefits to PDCO’s sales from the CEREC upgrade cycle are well understood by investors (roughly 20 percent of current CEREC owners have signed to upgrade to the new MC XL milling unit), visibility into new user demand for CEREC is limited. While the launch of the E4D system from D4D/HSIC could remove one overhang on chairside CAD/CAM demand and move some dentists off the sidelines, further expansion of CEREC capabilities could also drive interest in this system. If this happens, North American penetration rates for chairside CAD/CAM systems could move from 8 percent to potentially the low double-digit range over the next two to three years.

Benco Dental: We had the opportunity to meet with both Benco Dental President Chuck Cohen and his father (and second generation Benco owner) Larry Cohen at the ADA meeting. Benco Dental is the third largest distributor in the U.S. and holds roughly a 6 percent to 7 percent share of the $6.4 billion North American dental distribution market. Year-to-date, Benco has delivered a healthy 15 percent growth and has made one acquisition (KernCo Dental Supply). Our conversations with Mr. Cohen provided a similarly healthy outlook for dental market performance. He sees a large opportunity for the industry with intraoral digital radiography, 3-D CBCT systems, and recently launched soft tissue lasers. While investors often question if and when Patterson or Henry Schein will acquire Benco, we hope Benco remains independent, as not only does a third key player keep competition fair and rational, but we’d miss Chuck’s lively and frank assessments of the dental industry!

Jeffrey D. Johnson, OD, CFA, is Baird’s senior analyst covering medical technology. Prior to joining Baird in 2003, he was an optometrist and the associate director of Refractive Surgery Services at the Massachusetts Eye and Ear Infirmary, an instructor of ophthalmology at Harvard Medical School, an adjunct-assistant professor of optometry at the New England College of Optometry, and an equity research intern at Baird. Johnson received his MBA from Northwestern University, graduating summa cum laude. Salutatorian at the Illinois College of Optometry, he did his undergraduate work at the University of Illinois-Urbana.