Wall Street’s View of the Dental Industry - Spring 2007 Dental Office Survey

by Jeff Johnson, OD, CFA

After outperforming the S&P by 1.6% in 2006, dental stocks started even better in 2007 with the Robert W. Baird Dental Index (a dental stock index we calculate using market-cap weighted returns from Henry Schein, Patterson Companies, DENTSPLY, Sirona, Align Technologies, Young Innovations, and Biolase Technology) up 5.0% in Q1 vs. the S&P 500’s 0.2% gain. With Patterson and Align having posted solid gains since the end of the first quarter, Q2 is off to a good start, too.

In order to keep readers abreast of key issues expected to impact dentistry over the remainder of the year, we recently surveyed 364 Dental Economics® readers (85% general dentists, 15% specialty dentists) regarding dental patient traffic flow expectations, the impact of DENTSPLY’s late-2006 distributor consolidation efforts, and interest in CEREC upgrades, dental lasers, and the new 3-D Cone Beam Computed Tomography technology.

In the following pages, we provide a summary of key findings from this survey. While we interject our thoughts and opinions regarding the results of this survey throughout this report, we understand there can be interpretations and opinions that differ from ours. Also, while some of the results of this survey may be skewed by limited sample sizes and selection biases, we believe the results provide a good snapshot of current industry trends.

Response/Reaction to DENTSPLY’s U.S. Distributor Consolidation Initiative

One of the leading questions our dental investors have had in recent months involve DENTSPLY and the extent to which the company’s 2007 domestic sales growth may or may not be impacted by the company’s late 2006 decision to consolidate its U.S. distributor network. As many of you are aware, leading dental consumable manufacturer DENTSPLY announced last fall that it was consolidating its U.S. distributor network from more than 200 distributors to 28, a move the company expects will help improve its U.S. sales growth over time.

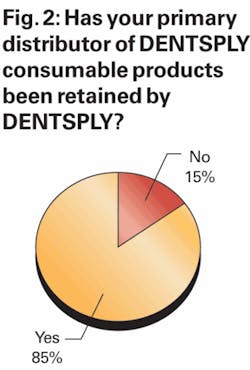

In order to assess how successful DENTSPLY has been in retaining dentists who had been served by its discontinued dealers, we asked dentists several questions regarding how their purchase trends involving DENTSPLY products had changed in recent months. First, we asked respondents if the primary distributor through which they had been purchasing their DENTSPLY products was still distributing DENTSPLY products.

As shown in Figure 2, approximately 85% of survey respondents indicated that their primary distributor continues to distribute DENTSPLY products, while 15% of respondents indicated their primary distributor is no longer distributing DENTSPLY product. These results were nicely in line with our expectations given that DENTSPLY has previously stated that discontinued dealers previously been responsible for ~10% of U.S. distributed product sales.

We then asked those respondents who indicated that their primary distributor was no longer distributing DENTSPLY product to provide an indication of how much DENTSPLY product they continue to purchase through a different distributor that had, instead, been retained by DENTSPLY. Responses to this question can be seen in Figure 3.

With responses relatively well-balanced between the four choices, we have tried to estimate what percentage of DENTSPLY’s U.S. distributor sales the company has successfully been able to retain.

To do this, we multiplied the percentage of respondents for each response by the percentage of DENTSPLY product we estimate respondents in that category continue to purchase. Specifically, we estimated that “Stayed with same distributor/Primarily switched to non-DENTSPLY product” corresponded to that respondent still purchasing DENTSPLY products at a level of approximately 10% of his or her original level. We assigned values of 25%, 75% and 90% to the other three categories.

Through this calculation, we estimate that DENTSPLY has retained roughly 40% of the business that previously was distributed by what are now discontinued dealers. For DENTSPLY investors, we view this as a positive result, as we believe it indicates there should be no more than a low single digit drag on the company’s U.S. business over the next few quarters as it relates to this change.

To be fair, however, we also realize these survey results indicate that a number of regional/local dealers who were cut off from the DENTSPLY network have successfully leveraged their great relationships with dental customers to maintain over half of their previous DENTSPLY business by switching these customers to other brands. Several successful, value-added distributors with whom we have spoken to have even indicated that their retention rates have been even higher, in the 75%+ range.

Interest in New CEREC Upgrades

A favorite topic of dental investors and industry veterans over the years has been CEREC, and the extent to which CEREC penetration may reach over coming years. With CEREC manufacturer Sirona having recently begun to introduce a number of exciting new enhancements to the CEREC chair-side system, we thought it would be a good time to poll dental offices and current CEREC owners to gauge interest in these upgrades and to try and determine whether these upgrades could drive increasing penetration of CEREC and other CAD/CAM in-office based systems over time.

We first asked respondents whether they were current CEREC owners, with the intent of establishing a respondent base for further questions regarding interest in upgrading to the new MC XL milling unit that has recently been introduced.

The 11% of respondents who indicated that they already own a CEREC unit was in line with the 12% who reported owning a CEREC in our fall 2006 dental survey. But as we noted last fall, this suggested level of penetration likely reflects a selection bias inherent in our survey as current U.S. penetration is estimated by Patterson and Sirona to be closer to 6%, not 11% or 12%.

In other words, we believe dentists who are more engaged in the industry and who are practicing at the leading edge of their profession are more likely to be reading and responding to our survey and are similarly more likely to own a CEREC system, thus overestimating the true penetration level of this technology.

We then asked those respondents who indicated that they currently own a CEREC system whether or not they were considering upgrading to the new MC XL milling unit. As shown in Figure 5, the majority (60%) of CEREC owners were interested in upgrading to the new milling unit, and 42% of those interested in upgrading commented that they were likely to do so in the next six to 12 months.

With an upgrade cost in the $18,000-$36,000 range, these results lead us to believe that upgrade revenue from current CEREC owners to the MC XL could represent a meaningful near-term growth driver for manufacturer Sirona and distributor Patterson.

We also asked those respondents who do not currently own a chair-side CAD/CAM system whether or not they planned on purchasing such a system within the next six to 12 months.

Approximately 3% of these respondents indicated that they anticipate purchasing a CEREC over the next six to 12 months, a number that is relatively in line with the 5% of respondents to our fall 2006 survey who indicated they were planning to purchase a CEREC system at some time in the next two years.

We then asked those respondents who plan to purchase a CEREC system over the next six months whether they expected to purchase the system with the new MC XL milling unit (at a total system cost of roughly $102,900) or the standard CEREC system without the faster MC XL milling unit (at a total cost of roughly $87,900). As shown in Figure 6, 100 percent of those respondents who anticipate purchasing a CEREC are planning to do so with the new MC XL milling unit.

To us, this response suggests that - even if CEREC upgrades do not drive meaningful acceleration in unit growth - the price premium that the newer-generation CEREC system commands could help Patterson’s dental equipment growth accelerate over the next six to 12 months.

In fact, these results were instrumental in our decision to upgrade shares of Patterson Companies (NASDAQ: PDCO) to an Outperform rating from our prior Neutral rating in early April of this year. While it’s still too early to tell whether our more bullish stance on PDCO after reviewing the results of this survey and other due diligence we performed prior to our upgrade will prove accurate, shares of PDCO have recently performed well. They traded up to $37 as recently as April 27 vs. $33 when we upgraded the stock.

Interest in Dental Laser Technology

We also found in our survey that practitioner interest in dental lasers was surprisingly high. Just more than 20% of respondents indicated owning a soft- and/or hard-tissue laser and 30% of respondents who do not currently own a dental laser stating that they plan on purchasing such a system within the next two years.

Of those respondents who indicated interest in buying a dental laser, we asked what brand they were most likely to buy. As shown in Figure 8, Biolase was the dominant choice. Sirona was the second most likely source through which a dental laser was expected to be purchased, likely reflecting familiarity with the company’s recently launched SIROLaser.

Interest in 3-D Cone Beam Computed Tomography

Finally, we asked survey respondents whether they were considering an investment in a 3-D Cone Beam Computed Tomography system at some point in the future. With average price tags for this advanced technology north of $160,000, CBCT’s have quickly become a hot topic for manufacturers, distributors, and, of course, investors.

Interest in CBCT technology was higher than we would have expected with 14% of respondents (18 specialists and 30 general practitioners) indicating that they are considering an investment in CBCT technology, although self-selection bias - as noted previously with CEREC-related questions - likely contributed to this above-expected interest.

We then asked those dentists who were considering an investment in CBCT what brands they were most aware of and were most likely to consider purchasing in the future.

Practitioners were most aware of market leader ISI’s i-CAT system, which is exclusively sold in North America via distributor Henry Schein. Following ISI, Planmeca’s ProMax system and Sirona’s recently launched Galileos system were most recognized and likely to be purchased.

In the coming months, we plan to follow up with a more in-depth survey of those practitioners who responded that they are considering the purchase of a CBCT system.

Again, thanks to all of you who took the time to answer our survey. We look forward to hearing from you again this summer when we release our next survey. But, in the meantime, if you have any feedback, please do not hesitate to contact us. Feedback from the field (even if you think we are dead wrong in our opinions regarding these results!!) is valuable and much appreciated!

Jeffrey D. Johnson, OD, CFA, is Baird’s senior analyst covering medical technology. Prior to joining Baird in 2003, he was an optometrist and the associate director of Refractive Surgery Services at the Massachusetts Eye and Ear Infirmary, an instructor of ophthalmology at Harvard Medical School, an adjunct-assistant professor of optometry at the New England College of Optometry, and an equity research intern at Baird. Johnson received his MBA from Northwestern University, graduating summa cum laude. Salutatorian at the Illinois College of Optometry, he did his undergraduate work at the University of Illinois-Urbana.