Wall Street’s view of the dental industry

By Jeff Johnson, OD, CFA

After returning 17% and solidly outperforming the S&P 500’s 4% gain in 2007, dental stocks are off to a rockier start in 2008, with the Robert W. Baird Dental Index having fallen 8% YTD vs. a YTD decline for the S&P 500 of roughly 5% (returns as of May 30, 2008). For clarity, we note that our dental stock index is calculated by taking market-cap weighted returns from DENTSPLY, Henry Schein, Patterson Companies, Sirona, Align Technologies, Young Innovations, and Biolase Technology, and excludes companies that have dental exposure but are not pure-plays in the space (Danaher, 3M, Zimmer), dental service providers (American Dental Partners, National Dentex), and internationally traded companies such as dental implant leaders Nobel Biocare and Straumann.

From an individual stock standpoint, Biolase Technology has been the best performer in the group this year, rising 38% as it has bounced from a 73% decline in 2007, while other dental stocks have been flat-to-down through the end of May: PDCO flat, HSIC -9%, XRAY -10%, and SIRO -11%. Underperformance for the group thus far in 2008 is in contrast to a solid five-year trend in which the dental group has outperformed the S&P 500 by a significant margin (+97% for dental group vs. +47% for S&P 500 over the past five years).

In an effort to stay abreast of key issues likely to impact dental industry performance in 2008, we recently surveyed 245 Dental Economics® readers (sample profile on next page) and asked a broad swathe of questions regarding current trends and overall expectations for the year. Specific areas we focused on in our survey included past, current, and future patient demand for services, patients’ willingness to spend on certain dental treatments, dentists’ awareness of recently revised/increased small business tax incentives for capital equipment purchases, interest in advanced technologies, and patient reaction to recent press regarding offshore lab restorations. You’ll see that many of these questions explore the impact a sluggish economy might be having on the industry in 2008.

Following, we summarize key takeaways from this survey – at least as we see them – although we fully acknowledge there is a wide range of interpretations and opinions that can be drawn from these survey results. Additionally, while some of the results of this survey may be skewed by a limited sample size and inherent selection biases within the survey sample, we believe the results provide a good snapshot of current industry sentiment and trends.

Recent and expected patient traffic flow

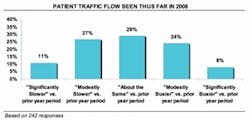

Given a multitude of headlines regarding a sluggish U.S. economy and potential fallout from declining property values and rising energy prices, we first focused on patient visits, asking respondents if they’ve seen any change in patient demand thus far in 2008 and what their expectations are for patient traffic flow through the balance of the year.

Most respondents offered a fairly neutral tone regarding patient traffic flow trends seen thus far in the year, with the results showing a relatively normal distribution centered around the “About the Same” response. Responses were more positively skewed to the right, however, when it comes to patient demand expected over the entire year, suggesting to us that either a nice acceleration is expected over the next few months or current trends are a bit below expected and that demand is expected to return to more normalized levels in the back half of the year.

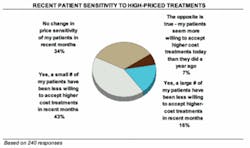

Patient willingness to spend on treatments and the impact of economy

We also asked respondents about potential changes they may have noticed regarding the sensitivity of patients to high-priced treatments and whether patients have been less willing to accept higher-cost treatments in recent months. Whereas feedback on patient traffic flow was relatively neutral, feedback on patient acceptance of high-priced treatments was slightly-to-moderately negative. Nearly 60% of all survey respondents indicated that patients have been less willing to accept higher-cost treatments in recent months, with 43% of respondents indicating a small number of patients and 16% of respondents indicating a large number of patients have been less willing to accept higher-cost treatments in recent months. The remaining survey respondents have either seen no change in price sensitivity among their patients (34% of all respondents) or believe patients have become more willing to accept higher-cost treatments in recent months (7% of all respondents).

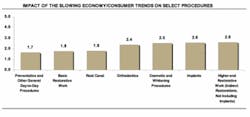

We then asked survey respondents to rate the impact the economy has had on demand for specific procedures, with 1 = No Impact, 2 = Slight/Barely Noticeable Negative Impact, 3 = Modestly Negative Impact on Procedure Demand, 4 = Significant Negative Impact on Procedure Demand, and 5 = Demand has Essentially Evaporated. As we largely expected, little impact or only a slightly noticeable negative impact has been seen with regard to day-to-day preventative procedures and those procedures that cannot be readily postponed (i.e., root canals and basic restorative work). For those procedures and products more closely tied to consumer discretionary spending, however, the impact has been slightly larger, with the average response split fairly evenly between “Slight Negative Impact” and “Modest Negative Impact.” We conclude from these responses that although the economy does not appear to be having a significant impact on patient demand for many dental procedures, there does appear to be a modest impact on procedures that are more closely tied to consumer discretionary spending or are considered higher-end.

Dental equipment outlook: Awareness of small business tax incentives

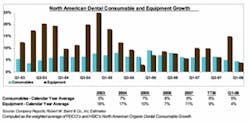

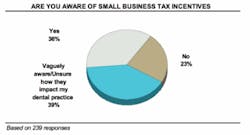

While the dental equipment market represents less than a third of the total North American dental market, it seems to receive greater scrutiny from investors as it has proven more volatile than dental consumables over the years. As we show in the lower chart on this page, in recent years dental equipment market growth has largely outpaced dental consumables market growth, but given the push and pull of a slowing economy vs. recently enacted small business tax incentives, investors have increasingly questioned whether or not this outperformance will continue over coming quarters

We asked dentists if they were aware of these tax incentives and whether these tax incentives impacted their decision to upgrade or purchase additional dental equipment in 2008. Surprisingly, while at the time of our survey it had only been two months since President Bush signed the 2008 Economic Stimulus Package into law, 34% of surveyed dentists reported that they were already aware of the small business tax incentives and an additional 42% reported that they were vaguely aware of these incentives. We note that a number of our checks at private and public dental manufacturers, distributors, and finance providers indicate that they have already begun marketing to dentists the potential benefits that could be realized through these incentives and/or the lower interest rates currently available to dentists.

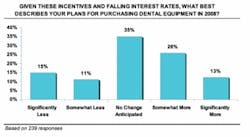

When then asked whether these tax depreciation incentives and falling interest rates leave them more likely to purchase dental equipment in 2008, nearly 40% of respondents indicated yes. Additionally, a portion of those dentists who reported “No Change Anticipated” actually provided commentary that they continue to anticipate investing in dental equipment in 2008, just that these incentives and falling interest rates do not change their plans. Just over 25% of respondents indicated that they anticipate spending less on dental equipment in 2008 despite these tax depreciation incentives and lower interest rates.

High-tech equipment interest

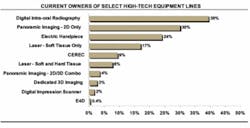

Beyond favorable tax incentives and low interest rates, the need for a shrinking dentist population to better serve a growing population has been a key driver of high-tech dental equipment sales in recent years. In the figure at left, we highlight penetration rates of select high-tech equipment lines among dentists that participated in our survey.

Because dentists who respond to this survey were all Dental Economics® readers and therefore likely tend to be highly engaged in their practices and the business side of dentistry, we believe our sample population is not fully representative of the true dental population and that penetration rates suggested from our survey likely overestimate true penetration rates for the industry. That said, we believe the ownership distribution accurately reflects general trends in the industry, with digital and panoramic X-ray systems enjoying significantly greater market penetration rates when compared to lasers, 3D imaging systems, and chairside restoration systems.

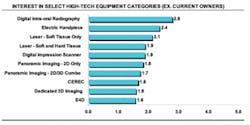

We then asked respondents to rate their interest in purchasing a number of different technologies over the next one to three years, with a 1 representing No Interest and a 5 representing an absolute intent to purchase. By taking a weighted average of the survey responses to this question and after excluding current owners of each respective technology, interest levels for each technology were calculated to be the following:

Not surprisingly, even with more dental offices reporting digital radiography ownership vs. any of the other “high-tech” equipment lines highlighted above, interest in digital radiography remains robust. Specifically, nearly one-third of respondents who do not currently own such a system reported that they either absolutely plan to purchase digital radiography over the next one to three years (a response of 5 in the figure above) or that there is a 75% chance they will purchase the technology over the next one to three years (a response of 4).

Outside of digital radiography, electric handpieces and soft tissue lasers also scored relatively high on a relative basis in our survey. Higher-end products, including 3D digital imaging, chairside restoration systems (including both CEREC and E4D) and digital impression scanners scored in the mid-to-upper 1 range on a weighted average basis.

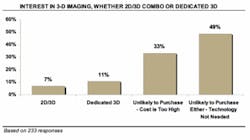

Rounding out the dental equipment part of our survey, we asked respondents to comment specifically regarding interest in dedicated 3-D imaging system and/or a combined 2D/3D imaging system. Of 233 responses to this question, just over 40 respondents voiced an interest in some form of high-end imaging product, with a slightly greater skew towards dedicated 3D systems vs. the combination 2D/3D products recently launched by a number of dental equipment manufacturers. To be fair, however, we also remind readers that these combination products have only recently been introduced and thus most dentists have likely not had the chance to evaluate the cost/benefit ratio of purchasing 3D vs. 2D/3D systems. Finally, we note that the majority of survey respondents indicated that they were unlikely to purchase one of these higher-end imaging systems, either because of cost issues (33%) or because they felt the technology wasn’t applicable to their practice (49%).

null

Offshore dental labs

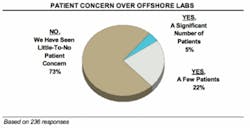

Following recent media reports regarding a dental crown that was produced in a Chinese dental lab and found to contain lead, we asked dentists (1) if they have sensed any concern from patients regarding this issue and (2) if their labs currently outsource to an offshore lab. As can be seen in the figure at left, 73% of survey respondents have seen little-to-no patient concern from recent press regarding this issue, 22% of respondents have seen a few patients voice concern over the issue, and 5% of survey respondents have seen a significant number of patients voice concern.

When asked what percentage of their dental restorations are currently sourced from offshore dental labs, the vast majority of dental survey respondents (87%) chose “None,” while an additional 5% of respondents cited “0-10%,” 3% of respondents cited “10-15%,” and 4% of respondents cited that they were “Unsure/Don’t Know.” We believe these results suggest many dentists may not know if the lab they are working with is sourcing some of the more basic restoration processes to offshore labs (while many labs do not outsource without providing notice to the dentist, our checks indicate that a number of labs do) as the ADA estimates 15-20% of dental prosthetics used in the United States originate from foreign labs.

We hope you find these survey results as informative and interesting as we do. If you have any feedback in the meantime, please do not hesitate to contact us by sending an email to [email protected]. Feedback from the field (even if you think we’re dead wrong in our opinions regarding these results!) is valuable and much appreciated!

Jeffrey D. Johnson, OD, CFA, is Baird’s senior analyst covering medical technology. Prior to joining Baird in 2003, he was an optometrist and the associate director of Refractive Surgery Services at the Massachusetts Eye and Ear Infirmary, an instructor of ophthalmology at Harvard Medical School, an adjunct-assistant professor of optometry at the New England College of Optometry, and an equity research intern at Baird. Johnson received his MBA from Northwestern University, graduating summa cum laude. Salutatorian at the Illinois College of Optometry, he did his undergraduate work at the University of Illinois-Urbana.